Open a Chime Checking Account in 2 Minutes.

We’ll spot you up to $200*.

Privacy Policy › Terms & Conditions ›

*SpotMe® eligibility requirements and overdraft limits apply. Banking services and debit card provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC.

Your money shouldn’t cost money.™

No monthly fees

No minimum balance fees

No foreign transaction fees

No transfer fees

Get paid up to 2 days earlyˆ with direct deposit.

Over 50k fee-free ATMs˜.

Fee-free overdraft up to $200*.

24/7 live support, with a real human.

Debit Card

Your money shouldn’t cost money.®

Credit Builder

Start building credit stress-free.

Safe, secure & trusted by millions.

Your funds are FDIC insured up to $250,000 through The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC† and we keep your money safe and secure with periodic security tests of our systems.

Funds FDIC Insured through Bank Partners

Deposits are FDIC insured** up to $250,000 through The Bancorp Bank, N.A. or Stride Bank N.A.; Members FDIC.

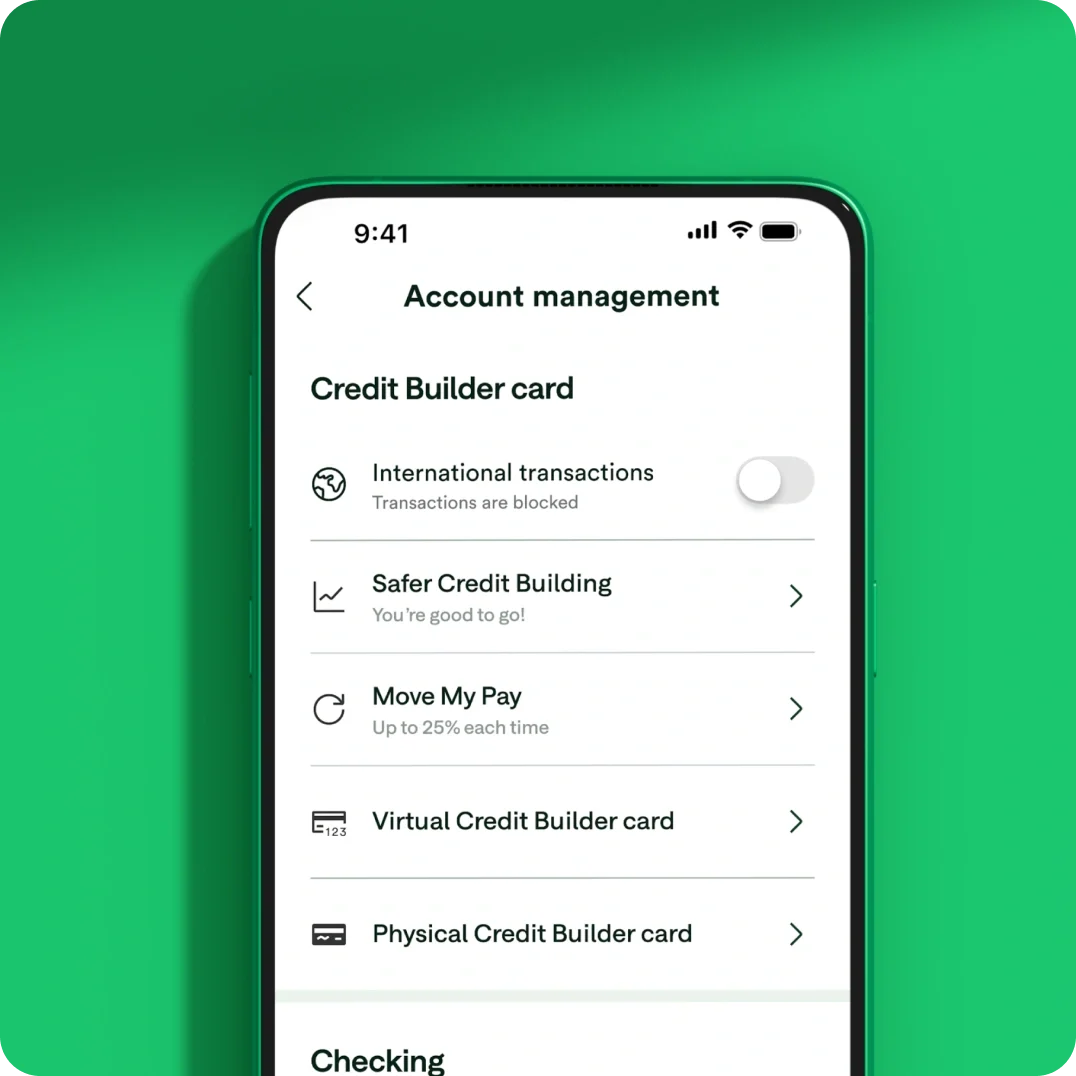

Block Your Card

If your card is missing or you suspect unauthorized use, you can block all transactions on your Chime Debit Card and Credit Builder card. Open the Chime app and disable transactions to immediately prevent new debit or credit card purchases or ATM withdrawals.

Real-time alerts

Chime allows you to receive instant transaction alerts anytime you use your Chime debit card. Turn on daily notifications so you always know what’s happening with your money.

Privacy and Security

We support two-factor authentication and support fingerprint authentication.

We're changing the way you feel about money.

Join the millions of members on Chime and feel good about your finances.

My score went up over 60 points and I bought my first car.†

With Chime, I’m saving hundreds of dollars a year.

Early payday guarantees that I can make it to any gig, any rehearsal, anytime.^

Real members. Paid testimonials.

Make the switch today.

FAQs

What is Chime®?

Any individuals 18 years and older are welcome to apply! While Chime cards work all over the world, currently we can only offer accounts to members with a valid SSN, living in the United States and District of Columbia.

What is Chime's mission?

Our mission is to unite everyday people to Unlock Financial Progress™. We’re doing that by changing the way people feel about banking. Chime’s business was built on the principle of protecting our members and making managing your money easy. We’ll never profit from your misfortune or mistakes and everything we build is focused on improving our member’s lives.

Who can use Chime?

U.S. Citizen or legal resident of the United States 18 years and older are welcome to apply! While Chime cards work all over the world, currently we can only offer accounts to members with a valid SSN, living in the United States and District of Columbia.

How does Chime make money?

Chime makes money from the interchange fee charged on card transactions. Every time you use your Chime Visa® Debit Card or Credit Builder Secured Credit Card for purchases and paying bills, Visa processes the transaction and charges an interchange fee to merchants for the service. Chime receives a portion of this fee. This is how Chime can continue building new and better products that help members get the most from their money.

When do I receive my Chime Visa® Debit Card after I open a Chime Checking Account?

After you open a Checking Account, we get started on personalizing your new Chime Visa Debit Card. Your Chime Visa Debit Card is usually placed in the mail within one (1) business day after you open your Checking Account. It can take 5 to 10 business days for your Chime Visa Debit Card to arrive at your home address.

If you don’t have your Chime Visa Debit Card within 10 business days after opening your Checking Account, please contact our Member Services team at 1-844-244-6363.

Does Chime charge any fees?

We have no fees to sign up, no overdraft, no monthly service fees, no minimum balance fees, and no card replacement fees either. We do charge two fees. (1) $2.50 when you get cash from either an over the counter withdrawal, or an out-of-network ATM that is not part of Chime’s fee-free network of 50,000+ ATMs~. $2 to receive funds instantly through MyPay®.

Please note that third-party services, such as money transfer services used to deposit funds or out-of-network ATM. You can access your money at 50,000+ in-network fee-free ATMs~.

Will I ever be charged an overdraft fee through Chime?

No. If you don’t have sufficient funds in your Chime Checking Account or have reached your SpotMe limit (if enrolled), your Chime Visa® Debit Card will be declined. There is no fee for declining transactions or for utilizing SpotMe.

What do I need to apply for a Credit Builder?

All you need is an active Chime® Checking Account.

Don’t have a Chime Checking Account? Apply for one in under two minutes!

Will it require a hard credit check to apply?

No way! We think everyone deserves a chance to build credit, so we don’t check your credit score when you apply.

Do I need to have a Chime Checking Account to use Credit Builder?

Yes. We designed Credit Builder to work with the Chime Checking Account so that you can move money instantly—across your Chime accounts!

How can Credit Builder help my credit score?

Credit Builder offers features that help you stay on top of key factors that impact your credit score. Consistent use of Credit Builder can help you build credit with on-time payments and increase the length of your credit history over time. We report monthly to the major credit bureaus – TransUnion®, Experian®, and Equifax®.

Learn more about credit building with Credit Builder.